Where the Water Meets the Horizon

Photo credit: Craig Merrill. Follow Craig on Instagram at: cragarsittingraven

Along the edge of downtown Anacortes you will find Cap Sante Marina. The Marina is more than just a place to dock a boat. It is a front-row seat to the rhythm of life on the water. It is where the water meets the horizon the sailboats gently sway in their slips, fishing vessels come and go with the tides, and the salty breeze carries the unmistakable feeling of coastal living. With easy access to the San Juan Islands and the Salish Sea, the marina is a hub for boaters, explorers, and anyone who appreciates life lived close to the water.

Just above the marina is a hill that overlooks the harbor and offers one of Anacortes’ most memorable viewpoints. It is called Cap Sante Park. From this elevated perch, the scene opens up in every direction. Look out to rows of masts lining the docks at the marina below, across the City of Anacortes, to March Point, Fidalgo Bay and the majestic Cascades. At sunrise, the marina glows with soft morning light; at sunset, the sky transforms into layers of gold, pink, and deep blue, making it a favorite spot for locals to pause and take it all in.

Whether you are strolling the waterfront, heading out for a day on the water, or simply soaking in the view from above, the Marina captures the essence of this coastal town. Feel relaxed, enjoy the scene, and be deeply connected to the sea. Let it be a reminder that sometimes the best part of where you live isn’t just the destination, but the view along the way.

If you don’t live in Anacortes but are interested in calling it home, connect with us.

Not Physically There For Closing?

“How do I sign my closing documents if I’m not physically there for closing?”

Buyers that are relocating, traveling, or purchasing from out of the area frequently ask is: “How do I sign my closing documents if I’m not physically there for closing?” The good news is that you have options. The important part is understanding which documents can be signed remotely and which cannot.

Digital Signatures: Forms That Can Be Done Online

Some of your closing documents can be signed electronically using platforms like DocuSign. These typically include disclosures and preliminary paperwork that don’t require notarization. Digital signing is convenient, fast, and often helps keep the process moving forward while you’re away.

Wet Signatures: Forms That Must Be Signed in Person

Several final closing documents, specifically those that are related to financing and the transfer of ownership, require a wet signature. A wet signature means they must be signed in ink and notarized. Traditionally, this is done at the escrow office, which is usually the simplest and smoothest option when you are local.

When You Can’t Get to Escrow

If signing at the escrow office isn’t possible because you are not physically there for closing, there are alternatives:

-

Mobile Notaries:

A mobile notary can meet you at your home, office, hotel, or another agreed-upon location to complete the signing. This option offers flexibility but does come at an additional cost that is usually paid by the buyer with fees that can be $150 or more, depending on location and timing.

-

Buyers Overseas:

In some cases, when buyers are located outside of the United States, closings have been completed through a U.S. embassy or consulate. While this is possible, it often requires advance planning, availability, and strict scheduling.

Important Timing Considerations

It is important to keep in mind that closing dates can change. When using a mobile notary or an embassy, appointments must be scheduled in advance. If timelines shift, rescheduling can be difficult and may lead to added stress or delays right at the finish line.

The Bottom Line

If you are not physically there for closing, it doesn’t mean the transaction can’t move forward. However, it does mean that you must plan ahead. Each option comes with its own logistics, costs, and timing considerations. That is why it is always best to talk through your specific situation early, so we can choose the smoothest path and avoid last-minute headaches. It’s all manageable. Just start early if needed.

If you know you’ll be out of town or overseas during closing, let’s start the conversation early—I’m here to help coordinate the details and make the process as seamless as possible.

If you are thinking about buying and not currently working with an agent and would like to speak with one that understands this process and can help make it a smooth transition for you, connect with us!

Luxury Living with Sweeping Southwest Views

Welcome to a truly exceptional retreat where luxury, privacy, and breathtaking natural beauty come together. Overlooking the sparkling waters of Clear Lake and Beaver Lake, this upscale home offers panoramic southwest-facing lake, territorial, and mountain views. It is here that you will experience the kind of views that turn everyday moments into something extraordinary. Set on 5 private acres in Skagit County just 10 minutes away from Big Lake. This property delivers the rare balance of peaceful seclusion with the convenience of being just minutes from nearby cities. This is more than a home. It’s a lifestyle designed for comfort, entertaining, and year-round enjoyment. If this sounds like everything you have been looking for, keep reading to discover luxury living with sweeping Southwest views over clear lake and Beaver Lake.

A Refined Main Level Designed for Everyday Living

The main level welcomes you with elegant yet functional spaces that flow seamlessly together. At the heart of the home is the gourmet kitchen, thoughtfully designed for both serious cooking and casual gatherings. Set the stage for effortless entertaining with marble countertops, a custom-built walk-in pantry with extra lighting and a glass door, and premium appliances. Appliances like a Sub-Zero refrigerator and Wolf range and dishwasher.

The kitchen connects naturally to a warm living space anchored by a gas fireplace and HD TV, creating a perfect spot to relax or host friends. The formal great room adds flexibility for larger gatherings. A dedicated office provides a quiet space to work from home. Just off the garage is a laundry room, complete with a sink and additional pantry storage that adds everyday convenience without sacrificing style.

Lower-Level Entertainment at Its Finest

Downstairs, the home transforms into an entertainer’s dream. Movie nights become unforgettable in the private home theater. The theater features an upgraded projector, 10 plush leather seats, and a 100-inch screen. Adjacent is a spacious game and entertainment room that includes an electronic foosball table, full size shuffleboard table, and two mounted LED TV’s for game days with a fully equipped wet bar, including an ice maker, refrigerator, and dishwasher. Can you imagine yourself hosting everything from game days to intimate gatherings yet?

Ever describe yourself as a wine enthusiasts? If so, you will appreciate the wine cellar and tasting room. These rooms showcase rich wood wine racks and a stunning marble tasting table with a copper lined waterfall sink in the center. A private sauna adds a spa-like touch, while the independent built-in sound system throughout the lower level of the home and expands out across the deck to ensure the perfect ambiance in every space.

Upper-Level Comfort and Flexibility

The upper level offers a peaceful retreat at the end of the day. The primary suite is spa-inspired, featuring a jetted soaking tub, separate shower, double sinks, and generous his-and-hers closets. Two additional large bedrooms with spacious closets provide comfort for family or guests. Additionally, a versatile rec room can easily serve as an overnight guest space, game room, or creative studio. Bathrooms feature elegant travertine tile flooring, adding timeless appeal. Contributing to the luxurious experience is an intercom system that allows for easy communication between the upper and main levels.

Outdoor Living with Unmatched Views

Step outside and take in the views from over 1,500 square feet of multi-level decking, perfectly positioned to capture stunning sunsets and sweeping lake vistas. Relax in the hot tub, recently upgraded with a new motor and treated with salt enzymes, or enjoy summer evenings with friends thanks to the plumbed gas line for your BBQ.

A fenced dog run and fully fenced backyard provide peace of mind for pet owners, while the surrounding natural setting offers frequent sightings of local wildlife—adding to the sense of escape and tranquility.

Thoughtful Upgrades & Peace of Mind

This home is equipped with features that enhance comfort and reliability year-round, including:

- Generac whole-home generator for uninterrupted power during inclement weather

- New furnace (2022)

- New on-demand hot water heater (2022)

- Propane-fueled systems that ensure heat and fireplace use even during outages

According to the current owners, the privacy, wildlife, and ability to enjoy world-class amenities without being in the heart of a major city are what truly make this home special.

A Rare Clear Lake Opportunity

Built in 1990, this two-story home with a basement offers timeless craftsmanship paired with modern luxury. Located in the Sedro-Woolley School District, it’s a rare opportunity to own a private retreat that feels worlds away—yet remains conveniently close to everything Skagit County has to offer.

Get the rest of the details here.

If you’re searching for luxury living with sweeping Southwest views, let’s connect! This Clear Lake retreat is ready to welcome you.

This home is listed by: Becky Elde

The North Cascades

Wild Beauty Meets Endless Wonder in the North Cascades. If you have ever taken Highway 20 or stood at a lookout along the North Cascades Scenic Byway, you have experienced the difference. It is more dramatic, raw, and rugged than just about anywhere else in Washington. What makes The North Cascades so different? They aren’t just mountains! They are one of the most spectacular landscapes in North America. The product of being carved by ice, shaped by time, and wrapped in a sense of wildness that is difficult to describe but impossible to forget once experienced.

Welcome to the North Cascades: the “American Alps” that live up to their name in every way.

A Landscape Carved by Time and Ice

The North Cascades are some of the most rugged mountains in the continental United States. There’s a reason for that! For millions of years, glaciers have scraped, sculpted, and carved this region into sharp ridgelines, jagged peaks, plunging valleys, and steep-walled canyons.

It’s this geologic history that gives the range its dramatic appearance:

- Craggy peaks that cut into the sky

- Deep turquoise lakes fed by glacial runoff, like Diablo Lake

- U-shaped valleys formed by massive sheets of ice

- Waterfalls that appear to tumble from nowhere

Counts cite over 300 glaciers! For reference, North Cascade glaciers make up nearly a third of all glaciers found in the lower 48 states. By far, the largest collection in the Lower 48. These glaciers continue shaping the landscape today, leaving behind the striking blues and rocky textures the North Cascades are known for.

A Wilderness of Pines, Snow, and Untamed Beauty

The North Cascades are home to dense forests of cedar, fir, and pine that cling to the slopes and fill the valleys below. As you approach the higher elevations, the trees give way to wildflower meadows, windswept ridges, and snowy peaks that remain frosted long into summer.

It is here; you find:

- Towering evergreens that fill the air with the scent of resin and rain

- Snowfields and glaciers that glow blue in the afternoon light

- Wildlife like black bears, marmots, mountain goats, and soaring eagles

- Alpine lakes so clear that they reflect the peaks like glass

The North Cascades are remote enough to feel untouched, yet accessible enough that anyone can experience moments that feel like pure wilderness escape.

The North Cascades Highway: A Drive Like No Other

If there is one thing that elevates this mountain range even further, it’s the drive.

Highway 20 (the North Cascades Scenic Byway) is often called one of the most beautiful drives in the country. For good reason, every switchback and overlook reveals something new:

- The emerald waters of Diablo Lake

- The towering spires of Liberty Bell Mountain

- The vast, layered ridgelines stretching endlessly into the horizon

- Rivers, forests, and valleys that change color with every season

Whether you are stopping at lookouts, hiking a trail, or simply soaking in the view from your car window, the drive offers a sense of awe that builds mile after mile.

Fall lights up in fiery colors of oranges and golds. Winter wraps the peaks in white. Spring returns with roaring waterfalls, and summer unveils the full glory of alpine blue skies. No matter when you visit, the North Cascades feel like a new place every time.

What Makes the North Cascades So Special?

It’s a combination of drama, solitude, and sheer natural beauty. It is the feeling of seeing mountain after mountain fade into the distance, knowing most of them are untouched wilderness. It’s the sense that the land is old, powerful, and yet still shaping itself.

The North Cascades are special because they remind us of something rare:

There are still places where nature feels truly wild.

Thinking about calling the PNW home? Let’s Connect!

Winter’s Most Magical Visitors

Every fall, as the air cools and the fields between Mount Vernon and Anacortes turn golden and quiet, something extraordinary happens. The snow geese return gracing our skies and our fields. For months, drivers along Fir Island Road, Highway 20, and the backroads between Conway and La Conner are treated to one of the Pacific Northwest’s most spectacular natural events. Thousands upon thousands of brilliant white birds gather across the farmland. To experience it is like a living snowstorm settling on the fields.

They’re impossible to miss, and even harder to forget.

Who Are These Majestic White Birds?

These annual visitors Snow Geese. These birds are famous for their striking white bodies, jet-black wingtips, and soft pink bills. They are part of one of the largest migratory waterfowl populations in the world.

Snow geese spend their summers nesting in the Arctic tundra, from Alaska to Siberia. As winter approaches food begins to grows scarce. In response, they travel thousands of miles south in enormous flocks. Sometimes you will see them flying in the classic V-shape and other times traveling in swirling clouds of white until they reach the mild, food-rich lowlands of Washington.

Year after year, they have choose Skagit Valley as one of their favorite places to rest and feed.

Why Do Snow Geese Come to Skagit Valley?

Skagit Valley is a paradise for wintering geese. The landscape between Mount Vernon and Anacortes provides exactly what they need:

🌾 Open Farmland

Harvested agricultural fields leave behind residual grain, roots, and plant material making for an ideal buffet for hungry geese after their marathon migration.

🕊 Safe Gathering Space

Vast open spaces give flocks room to land, rest, and take off again with ease. The ability to see predators coming from all directions makes the valley especially attractive.

💧 Wetlands & Marshes

Nearby areas like the Skagit Flats, Padilla Bay, and the restored wetlands on Fir Island create the perfect environment for feeding, roosting, and preening.

🌤 Mild Winter Climate

Compared to the frozen Arctic, Skagit’s cool but temperate winter provides a comfortable refuge.

All of these combined creates the perfect seasonal home for snow geese. That’s why thousands upon thousands of snow geese return here every year, usually from October through March. To learn more about these magical visitors read this article: Snow Geese of the Pacific Flyway.

A Natural Spectacle You Don’t Want to Miss

Whether you are commuting between cities or intentionally going “geese chasing,” the experience is unforgettable.

Often you will see:

-

Giant flocks blanketing entire fields like a fresh layer of snow

-

Sudden eruptions of wings and sound making a thunderous “whooosh” as thousands lift off at once

-

Spiraling clouds of white birds sweeping across the sky

-

Black-tipped wings flashing as they move in synchronized waves

And sometimes, right before they land, they hover, feet dangling, wings fanned wide. In this moment they almost look as if they are moving in slow motion. It is like nothing else you’ve ever experienced before.

Photographers, birdwatchers, and families come from all over the region for the chance to witness scenes like these. For locals, it’s one of the many things that makes living in Skagit Valley so special.

How to See Them Up Close

You can spot snow geese reliably in these areas:

-

Fir Island (the most famous viewing location)

-

Between Conway and La Conner

-

Fields along Highway 20

-

Skagit Flats near Bay View and Edison

Just be sure to pull fully off the road, stay respectful of private property, and give the birds plenty of space to feed and rest.

A Seasonal Reminder of Why We Love Where We Live

For several months each year, snow geese turn our everyday drives into something magical. Their presence transforms simple farm fields into scenes worthy of a wildlife documentary. Winter’s most magical visitors remind us that Skagit Valley is full of wonder, even in the quietest seasons.

It’s one more reason to take the scenic route. One more reason to slow down. One more reason to appreciate the place we’re lucky enough to call home.

If you have come to witness this magic and have determined you want to call it home, connect with us we are happy to help you make your PNW living dreams come true.

Coastal Beauty Meets Everyday Adventure

Anacortes is one of those rare places where the line between everyday life and vacation living feels beautifully blurred. It is a place where coastal beauty meets everyday adventure. The mornings begin with golden light stretching over the water. The afternoons welcome long walks on forested trails. Last but not least, the evenings often end with sunsets that paint Burrows Bay in shades of rose and gold.

From the salty breeze off the marina to the vibrant local arts scene, there’s a rhythm to life in Anacortes that feels both invigorating and deeply grounding. Spend a Saturday discovering shops and cafés downtown, hop aboard a whale-watching tour, explore miles of scenic hiking in the nearby Anacortes Community Forest Lands, or launch your kayak into the glassy waters of the bay. When your heart desires to explore a little further, you are just a ferry ride away.

What truly makes Anacortes special is the lifestyle it has to offer. A lifestyle that blends natural beauty with a strong sense of community. Neighborhoods like Skyline that bring people together around beaches, sports courts, parks, clubhouses, and cabana with a shared love of the water. It’s an area designed for those who want to live close to the shoreline and even closer to adventure.

A Home That Amplifies the Anacortes Lifestyle

If you are thinking about making Anacortes your home and have ever dreamt of living where your home is as adventure-ready as you are, perhaps this updated Skyline property would do just that for you. 2016 Piper Circle Anacortes Listed by: Julie Birkle.

Boasting breathtaking views of Burrows Bay, the Olympic Mountains, and unforgettable sunsets, this 3,500+ SF home captures the essence of coastal living. Inside, you will find thoughtful upgrades throughout. Upgrades like granite kitchen counters, new appliances, refreshed bathrooms, a cozy gas fireplace, new windows, siding, decks, and fresh exterior paint. Modern comforts include a whole-house generator, tankless water heater, and a security system for peace of mind.

But one of the standout features is the incredible amount of parking and storage. This is a true rarity in the Pacific Northwest coastal market.

Space for Everything: RVs, Boats, Cars, and All Your Toys

Whether you are an RVer, a boater, an explorer, or all three, this home is built for the lifestyle.

-

Generous RV parking with dedicated sewer and power hookups

-

Room for a large RV, boat, toy hauler, or trailer

-

Additional off-street parking for multiple vehicles

-

Minutes from the Skyline Marina and boat launch

Imagine the ease of stepping out your door, loading up your gear, and heading straight to the mountains or the water with no hassle. This home offers no storage hassles, no off-site parking fees, no extra stops. This home quite literally puts adventure at your doorstep.

When you find yourself ready to stay close to home, enjoy Skyline’s exclusive amenities: a private beach, sports courts, parks, clubhouse, cabana, and the waterfront just a short stroll away.

Ready to Live the Anacortes Lifestyle?

If your heart belongs to the Pacific Northwest for its water, its wilderness, its slow coastal days paired with spontaneous adventure, this home offers the perfect place to plant roots.

With room for every vehicle, every toy, and every future plan, it’s more than a home.

It’s your launch point for life in Anacortes. Let’s Connect.

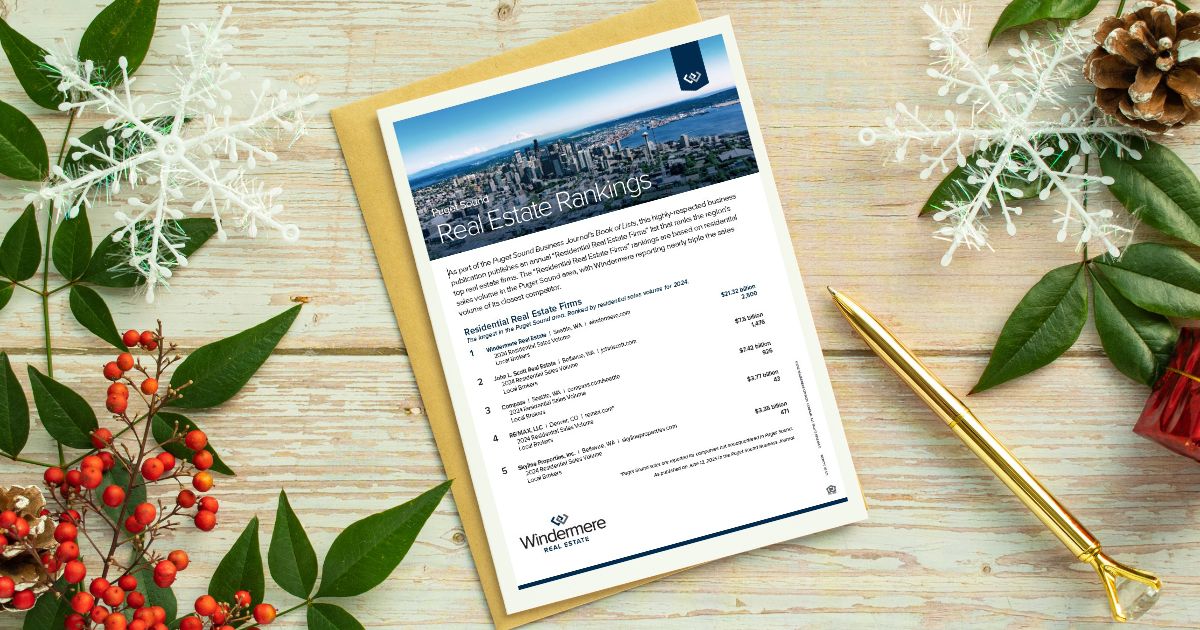

A Legacy of Market Leadership

We were thrilled to see the Puget Sound Business Journal’s most recent real estate rankings (check them out here). Windermere has been a legacy of market leadership in the Puget Sound. The report supports this by demonstrating how Windermere Real Estate continues to assert its position as the foremost residential real estate firm in the Puget Sound region. Reporting $21.32 billion in residential sales volume. Windermere’s performance outpaces its nearest competitor by nearly a threefold margin. This information reinforces Windermere’s longstanding dominance in the regional housing market.

The history:

The Puget Sound Business Journal inaugurated its list of top residential real estate companies in 1986. Windermere has maintained the No. 1 ranking every single year. This nearly four-decade tenure highlights not only Windermere’s market share but its sustained organizational resilience, strategic adaptability, and strong community presence. We are extremely proud to be a part of it.

Factor of Success:

Several factors contribute to Windermere’s enduring success. First, its expansive network across the Pacific Northwest supports unparalleled market coverage and client reach. Second, the emphasis on agent education, technological integration, and customer-centered service has strengthened its professional reputation and operational efficiency. Finally, Windermere’s deep-rooted commitment to community engagement. The Windermere Foundation, funded in part by a portion of every home sold distinguishes Windermere as both a market leader and a socially responsible organization. As Windermere offices and agents in the Puget Sound, we couldn’t be more proud.

Here is a snip-it into what our Anacortes, Sedro-Woolley, Skagit Valley, and Arlington offices have been doing in our communities recently:

What it all means:

Windermere’s continued ability to outperform their competitors at such scale suggests a robust alignment between regional market demands and Windermere’s business model. Housing markets across the Puget Sound area evolve in response to demographic shifts, economic pressures, and ongoing development patterns. Windermere’s legacy of leadership positions it uniquely to shape the future trajectory of real estate services in the region.

In sum, Windermere’s top ranking is not merely a reflection of annual sales. Windermere’s top ranking is a testament to nearly forty years of consistent excellence, strategic foresight, and unwavering commitment to all of the communities served. We are grateful for your continued trust in our services and look forward to continuing to serve you for years to come.

If you are looking to making a move in your future please reach out. We would love to help you. If you wish to have a copy of this document mailed or emailed to you please email us at northsound@windermere.com.

Discover the Magic of Diablo Lake

Nestled in the rugged wilderness of the North Cascades, discover the magic of Diablo Lake. Diablo Lake is one of Washington’s most breathtaking destinations. It is a special place where turquoise waters meet dramatic mountain peaks, and every turn along the highway feels like you are stepping into a postcard. You will find Diablo Lake just east of the charming Skagit Valley communities. This natural wonder makes for the perfect day trip or weekend adventure for locals and visitors alike.

The Magic Behind the Color

One of the most captivating things about Diablo Lake is its brilliant blue-green color. The vibrant hue comes from “glacial flour”. A phenomenon where fine rock particles created by glaciers grinding against stone stay suspended in the water. When the sunlight reflects off the particles it creates the surreal blue-green tone of lake with an almost otherworldly glow. You must see it to believe it.

Things to Do Around Diablo Lake

Whether you are an adventurer, photographer, or someone looking for a peaceful escape, there is something for everyone.

Hiking:

Explore the popular Diablo Lake Trail, a 7.2-mile trail with stunning viewpoints of the lake and surrounding peaks. The complete trail includes an elevation gain of 1,509 feet and generally takes about 3.5 to 4 hours to complete.

Boating & Kayaking:

During peak seasons you can rent a kayak or join a guided boat tour to experience the lake from the water and learn about the area’s fascinating history.

Picnicking:

The Diablo Lake Overlook offers one of the most scenic picnic spots in the state. Don’t just drive by, this is a must-see for anyone driving along Highway 20. Pack a lunch and stop to enjoy the view.

Camping:

If you plan for an extended stay, there are nearby campgrounds like Colonial Creek that offer the chance to fall asleep under a blanket of stars, surrounded by the sounds of nature.

A Connection to Home

For those who call the Skagit Valley, or the surrounding areas home, Diablo Lake is more than just a destination, it is a reminder of why we live here. The North Cascades showcase the incredible balance between wild beauty and accessible adventure that makes the Pacific Northwest lifestyle so special.

Diablo is a place that inspires gratitude for the land we live on and the communities that protect it. Whether you are new to the area or a lifelong resident, taking the time to explore places like Diablo Lake deepens your connection to this incredible corner of the world.

Real Estate and the PNW Lifestyle

Living near places like Diablo Lake means having nature’s playground right in your backyard. For homebuyers seeking both tranquility and adventure, properties in Skagit and Snohomish Counties offer a gateway to this lifestyle. Those lucky enough to live here can enjoy weekends spent hiking mountain trails or relaxing by the water. Every season brings new reasons to fall in love with the Pacific Northwest.

Ready to Find Your PNW Home?

If the idea of living close to scenic trails, alpine lakes, and charming small towns sounds like your dream, let’s connect. We would love to help you discover a home that fits your lifestyle, whether that is a cozy cabin tucked among the trees or a home with a view of the mountains that make this region so magical.

📞 Reach out today to learn more about homes near the North Cascades, or explore listings across Skagit and Snohomish communities.

Make Shorter Days Work For You and Your Home

When the clocks turn back and daylight fades a little earlier, life in Skagit and Snohomish takes on a cozier rhythm. The fields, forests, and towns glow in fall colors. The evenings become an invitation to slow down and enjoy the comforts of home. This article will help you embrace the season and learn how to make shorter days work for you and your home.

A Seasonal Shift with a Purpose

Originally, Day Light Savings was created to maximize daylight hours. While “Falling back” is not always welcomed with an abundance of joy, it does offer a reminder that every season brings its own kind of productivity. “Falling back” gives us a bit more morning light. This early light offers us a great excuse to refocus on the spaces we spend the most time in.

Indoor Inspiration

As evenings begin to grow darker, we are provided the perfect opportunity to make our homes feel brighter and more functional. Here are a few ideas to help.

Refresh Your Entryway:

Try adding hooks for coats, a doormat for rainy-day shoes, and soft lighting to create a welcoming first impression.

Cozy Corners:

Layer textures with throw blankets, pillows, and rugs to make living spaces warm and inviting.

Brighten with Color:

Incorporate autumn tones like amber, rust, or olive in decor. These small changes add warmth to shorter days.

Clean & Prep:

Use that “extra hour” to tackle small projects before the holidays — clean windows, deep-clean the kitchen, or declutter high-traffic areas. *Pro tip: Winter is coming start planning for winterizing your home now.

Real Estate Reflections

Even as daylight fades, the housing market keeps moving. Buyers touring in the evening will notice how well a home feels at dusk. The soft lighting, a pleasant scent, and tidy organization all make a difference for how the home feels. Sellers can use this season to stage their homes for warmth and comfort, appealing to the desire for a welcoming space as winter approaches.

As we “fall back,” remember that shorter days don’t have to mean less light. It just means we shift where we find it. Whether it’s in your home, your community, or a new chapter ahead, there’s always something to brighten the season. If you are thinking about buying or selling, let’s connect!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link