Safest way to dispose documents

Buying or selling a home can generate a lot of paperwork—some of it containing sensitive personal information. So, what should you do with it all once the transaction is complete? We suggest hanging on to most of it. As for the documents that you no longer need tossing them in the trash could put your personal data at risk. The safest way to dispose of old documents is through secure shredding.

🔐 What Should You Shred?

If a document contains any personally identifiable information (PII), it should be shredded. That includes:

-

Tax returns

-

Photo IDs and photocopies

-

Bank statements

-

Voided checks

-

Pay stubs

-

Credit card and billing information

-

Sale receipts with personal data

-

Anything with your name, address, phone number, or email

-

Employment or customer records

❌ What Not to Shred

While it may be tempting to shred everything, hold onto:

-

Property records and warranties (as long as you own the item or property)

-

Tax documents less than 7 years old

-

Legal contracts and loan documents (keep until fully paid or no longer active)

-

Birth certificates, Social Security cards, and other official government IDs

For more detailed guidance, we recommend this helpful resource from Suze Orman.

💡 Why Shredding Matters

Prevent Identity Theft:

Over 16 million Americans fall victim to identity theft annually. Shredding documents helps prevent your personal data from falling into the wrong hands.

Stay Compliant:

Businesses and individuals are legally responsible for safeguarding sensitive information. Shredding documents ensures you meet privacy protection standards.

Protect Employees & Clients:

Shredding is an easy way to ensure that anyone whose information you’ve handled is treated with care and respect.

Declutter Your Space:

Get rid of old files and enjoy a cleaner, more organized home or office!

🤝 We’re All In, For You.

At Windermere, we believe our role extends far beyond buying and selling homes. We are committed to empowering and protecting our community—and that includes helping you stay secure after the transaction is complete.

From educating clients on digital security to hosting events like this one, we are proud to stand by your side every step of the way.

📬 Got questions about what to bring or how the event works? Call us at 360.435.0700 or email us at arlingtonreception@windermere.com. We’re here to help.

Are You Ignoring Your Biggest Financial Asset?

How often do you check your bank account? Weekly? Daily? Multiple times a day if you’ve just booked a vacation or gone on a spending spree?

Now, ask yourself this: When was the last time you checked the equity in your home? Are you ignoring your biggest financial asset?

If you’re like most people, your bank balance gets far more attention than your home’s equity. But here’s the truth: Your home is likely your biggest financial asset—and it plays a huge role in your long-term wealth and financial security.

Why Home Equity Deserves More of Your Attention

Home equity is the difference between what your home is worth and what you still owe on your mortgage. As you pay down your loan and as your home’s value appreciates, your equity grows—often quietly, behind the scenes, while you go about your daily life.

It might not feel as tangible as the money sitting in your checking account, but over time, home equity can outpace your savings account by a long shot. The earlier you buy, the more time your equity has to grow. Not sure where to start but know that purchasing a home is in your future, don’t wait, connect now.

Real Estate as a Wealth-Building Tool

Buying a home early in life is one of the smartest financial moves you can make. Not only are you avoiding years of paying someone else’s mortgage (hello, rent!), but you are also building a financial cushion that can benefit you for decades.

Think of it this way: While your rent payments disappear each month, your mortgage payments are gradually turning into ownership—and growing equity. Over the years, that equity builds a powerful financial resource.

Equity in Retirement: More Than Just a Number

Fast forward to your retirement years. Maybe your 401(k) and savings accounts aren’t quite where you hoped they’d be. This is where home equity becomes your unsung hero.

Options like a Home Equity Line of Credit (HELOC) or a reverse mortgage can give you access to the equity you’ve built—without selling your home. This can be especially helpful for managing retirement expenses, covering healthcare costs, or simply enhancing your quality of life.

As Bill Perkins highlights in his book Die With Zero, the goal isn’t to hoard wealth indefinitely—it’s to strategically use it to maximize life experiences. Your home equity can help fund those bucket-list adventures, support family members, or allow you to retire more comfortably.

So, What Should You Do?

- Check your equity: Contact a local real estate professional (hi, that’s us!) for a quick home valuation. You might be surprised at how much your home is worth today.

- Understand your options: From HELOCs to smart refinancing, knowing what tools are available can empower you to make the most of your investment.

- Start early: If you haven’t purchased a home yet, consider it an investment in your future self. The earlier you start, the longer your equity has to grow.

Final Thoughts

Your bank account shows you what’s possible today. Your home equity shows you what’s possible for your future.

So the next time you log into your banking app, take a moment to think bigger. Your financial health isn’t just about what’s liquid—it’s about what you’re building. Real estate is one of the most reliable ways to build long-term wealth.

Want to know how much equity you have—and what it could do for your future? Let’s talk.

Harmony Harvest Bowl

After indulging in the Herbed Chicken with Wine Sauce from the Windermere Recipe Book—an absolute flavor-packed delight—we couldn’t let a single bite of leftovers go to waste. Determined to find a follow-up recipe just as delicious, we set out to create the perfect next-day dish. And trust us, it did not disappoint!

This Harmony Harvest Bowl brings a vibrant dish to the table. It is a flavor-packed bowl featuring tender shredded chicken, crisp colorful vegetables, hearty grains, sweet bursts of fruit, crunchy nuts, even cheese! Every bite is a perfect balance of texture and taste!

But don’t just take our word for it. Try it out for yourself and let us know what you think.

You might just find yourself preparing this ahead to send it in lunches, or feeding an entire crew by setting out all the fixings and more to let everyone Mix-and-Match to their liking.

Lets get to it.

Harmony Harvest Bowl Ingredients

- 1 1/2 cups of wild rice blend

- 2 2/3 cups unsalted chicken broth

- 2 Tbsp. butter – try Karrygold pure Irish Butter its a fan favorite

- 1 1/2 tsp. kosher salt, divided

- 1 lb of Brussel sprouts – washed, trimmed, and cut in half

- 2 small sweet potatoes – cut into small cubes

- 2 Tbsp. olive oil

- 1 tsp. ground black pepper

- 1 tsp. garlic powder

- 1 tsp. paprika

- 1/2 tsp. cayenne

- Shredded chicken from Herbed Chicken with Wine Sauce or a rotisserie chicken – shredded

- 2 cups of fresh baby kale

- 1 Honeycrisp apple – cut into cubes

- 1/2 cup of crumbled goat cheese

- 1/4 cup roasted sliced almonds, salted

Balsamic Vinaigrette

- 3 Tbsp. balsamic vinegar

- 2 tsp. honey

- 2 tsp. Dijon mustard

- 1 garlic clove – finely chopped or grated

- 1/4 tsp. kosher salt

- 1/4 tsp. ground black pepper

- 1/3 cup olive oil

Instructions

- Preheat your oven to 450ºF.

- Using a mesh strainer rinse your rice under water for about a minute.

- Add broth, butter, cleaned rice, and 1/2 teaspoon of salt to a medium saucepan.

- On medium-high heat bring the mixture to a boil then reduce the heat to low, cover, and cook about 45 minutes until the rice is tender.

- Remove the rice from heat but keep covered another 15 minutes then fluff the rice with a fork.

- While the rice is cooking, prepare your baking sheets with foil then drizzle olive oil over Brussel sprouts and sweet potatoes- toss to make sure they are well coated.

- Sprinkle with the remaining teaspoon of salt, pepper, garlic powder, paprika, and cayenne. Toss again to coat and spread evenly on baking sheet.

- Place baking sheets in preheated oven for about 12 minutes then stir to flip veggies and continue cooking for another 14 minutes until they are brown and tender.

- While veggies are cooking prepare the balsamic vinaigrette by adding balsamic vinegar, honey, mustard, garlic, salt, and pepper to a jar with a lid. Shake vigorously. Ingredients should be well mixed.

- Add olive oil and shake again.

- Store in the refrigerator and shake prior to each use.

- Prepare bowls with baby kale, rice, Brussel sprouts & sweet potatoes, shredded chicken, apple, goat cheese, top with roasted almonds, and drizzle with balsamic vinaigrette.

We know your tastebuds will thank you. If you tried this recipe and loved it don’t just share it with a friend but also let us know. Email us here.

Maximize Your Tax Refund

Maximize Your Tax Refund: Invest in Your Future Through Real Estate

Tax season often brings a pleasant surprise – a refund. As of February 7, 2025, the IRS reported an average refund amount of $2,065. That is an 18.6% increase from the previous year. Check out the details here.

If you’re contemplating how to make the most of this windfall, consider channeling it into real estate. Continue reading to discover several ways you can maximize your tax refund by investing in real estate.

Building Wealth Through Homeownership

Homeownership is a proven strategy for building wealth. Consider this, median sales price for all the Northwest MLS Housing Market (Washington State), rose to $640,000 in 2024. This is up 6.7% from the year prior. This positive increase reflects steady appreciation over the years.

By investing in property, you not only secure a place to call home but also position yourself to benefit from potential market gains.

Smart Ways to Utilize Your Tax Refund in Real Estate

Boost Your Down Payment

Saving for a down payment is often a significant hurdle for prospective homeowners. While the traditional 20% down payment offers benefits like avoiding private mortgage insurance, it’s not a strict requirement. If 20% seems unattainable you’re not alone. NerdWallet exposed that in 2023, first-time buyers typically put down 8% of the home’s purchase price.

Whether your goal is 20 or 8% your tax refund can bring you closer to this goal. The closer you are to your goal makes homeownership more attainable.

Cover Closing Costs

Closing costs encompass various fees, including loan origination, appraisal, and title insurance, typically ranging from 2% to 5% of the loan amount. For example, you would pay between $10,000 to $25,000 in closing costs in addition to the down payment on a $500,000 home loan.

Allocating your tax refund toward these expenses can ease the financial load at closing, allowing you to preserve other savings.

Purchase Mortgage Points

If current interest rates are a concern, consider using your refund to buy mortgage points. Each point, costing 1% of your loan amount, can reduce your interest rate, leading to substantial savings over time.

This upfront investment can lower your monthly payments and decrease the total interest paid over the life of the loan.

Make Extra Principal Payments

Applying additional funds directly to your mortgage principal can shorten your loan term and reduce the total interest paid. Even small extra payments can have a significant impact over time. Always consult with your lender to ensure there are no prepayment penalties.

Hot tip: Consider making an extra payment every year (perhaps your tax refund) and you could save thousands in interest over the course of the loan. For example, if your monthly mortgage payment is $3,000 and you making one extra payment a year it has the potential to save you $100,000 in interest and could cut 6 years off your mortgage.

Just imagine your future self, lounging in your dream home, sipping a cup of coffee, and thinking, “I’m glad I invested that tax refund wisely!” By making strategic decisions today, you can pave the way for a comfortable and secure tomorrow.

Partner with a Real Estate Professional

Embarking on the real estate journey can be complex. You don’t have to navigate it alone. A knowledgeable real estate agent can provide personalized advice, helping you make informed decisions that align with your financial goals. If you’re ready to explore your options, connect with us today. Let’s turn your tax refund into a steppingstone toward your dream home.

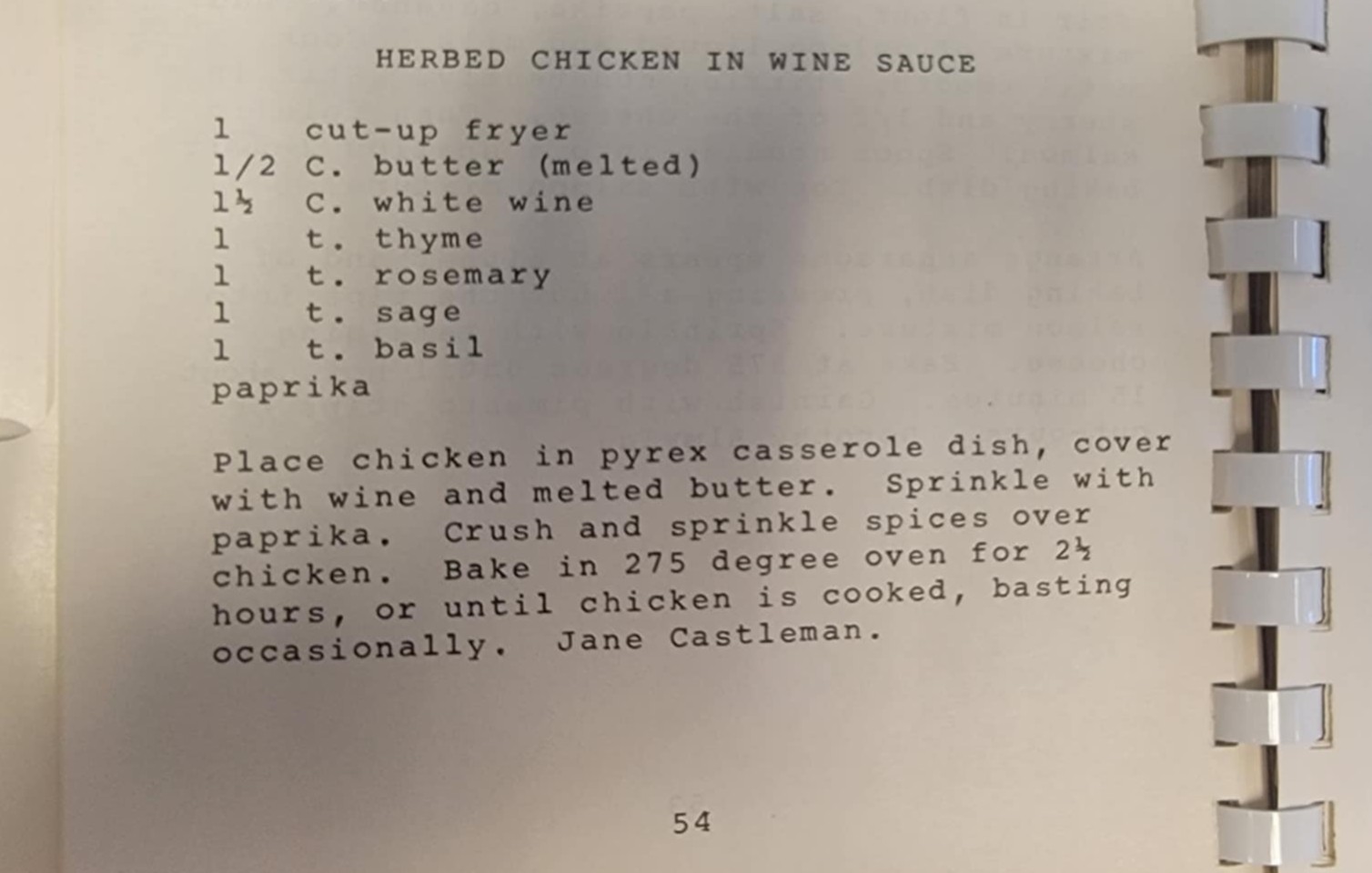

Herbed Chicken and Wine Sauce

A Taste of History: Rediscovering Windermere’s 1972 Recipe Collection

Some stories are best told through flavors, and today, we have a special one to share. This story begins in 1972 when a group of Windermere real estate agents compiled a collection of their favorite recipes into a cherished cookbook. Over the years, this book found its way into the hands of a Seattle attorney, who, decades later, was preparing to sell his home. In a heartwarming twist of fate, he reached out to his Windermere broker and returned the cookbook, bringing it full circle after all these years.

Now, as we flip through its well-worn pages, we are excited to bring these timeless recipes back to life. Among them, we discovered a delightful classic—one that captures the warmth and community spirit that has always defined Windermere.

HERBED CHICKEN AND WINE SAUCE

A timeless treat from the pages of the 1972 Windermere cookbook.

Ingredients:

- 1 cut-up fryer

- 1/2 C butter (melted)

- 1 1/2 C white wine

- 1 T thyme

- 1 T rosemary

- 1 T sage

- 1 T basil

- paprika

Instructions:

Place chicken in a Pyrex casserole dish, cover with wine and melted butter. Sprinkle with paprika. Crush and sprinkle spices over chicken. Bake in 275 degree oven for 2.5 hours, or until chicken is cooked, basting occasionally.

Recipe provided by: Jane Castleman

As we savor these savory flavors, we celebrate the enduring connections and traditions that bring us together. Whether you’re a longtime Windermere client or new to our community, we invite you to try this recipe and share in a piece of our history.

What’s your favorite family recipe? Let us know. If you contributed to this book we would love to here from you. Connect with us here. If you tried this recipe and you loved it let us know tag us @windermere_arlington on Instagram.

Windermere Agents Shine at the NPSAR Award of Excellence

The North Puget Sound Association of REALTORS® (NPSAR) Award of Excellence is more than just a recognition—it’s a testament to the dedication, professionalism, and community involvement of outstanding real estate agents in our region. This year, Windermere Real Estate agents made a remarkable impact, standing out as the largest group to receive this prestigious honor.

What is the NPSAR Award of Excellence?

This award highlights active real estate professionals who go above and beyond in their field. It not only acknowledges production achievements but also emphasizes leadership, participation, and engagement within the real estate industry. To qualify, agents must be active members of NPSAR in good standing and meet specific transaction criteria:

- A minimum of six closed sides or $3,500,000 in sales volume

- Accumulation of REALTOR® Involvement Points:

- Bronze Award: 100 points

- Silver Award: 125 points

- Gold Award: 175 points

Participation in association events, committees, and continuing education all contribute to an agent’s eligibility, ensuring that award recipients are not just successful in sales but also committed to elevating the profession and serving their communities.

Windermere’s Strong Presence

Windermere Real Estate agents dominated the awards this year, demonstrating both high production levels and a deep-rooted commitment to the industry. Their achievements reflect not only individual dedication but also the strength of Windermere’s culture—one that values education, leadership, and community service.

At Windermere, we believe real estate is about more than transactions; it’s about building relationships and making a positive impact. The recognition our agents received at the NPSAR Awards of Excellence reinforces this belief and highlights the exceptional service they provide to clients and the broader community.

Why This Matters to You

When you work with a Windermere agent, you’re partnering with a dedicated professional who is not only experienced in the market but also actively involved in shaping the future of real estate. Their commitment to excellence ensures you receive top-tier service, whether you’re buying, selling, or investing in property.

We are incredibly proud of our agents who were honored at the NPSAR Awards of Excellence. Their hard work and dedication set the standard for professionalism and community engagement in real estate.

Congratulations to all the award recipients! If you’re looking for an expert in the North Puget Sound real estate market, connect with a Windermere agent today. We’re here to help you achieve your real estate goals with excellence!

Don’t be Spooked when buying a rental

Don’t be Spooked when buying a rental –

We have connected with Michelle Schmidt from Movement Mortgage who has provided information from a lenders perspective on DSCR Loans.

Here’s what she has to say:

DSCR loans, or Debt Service Coverage Ratio loans, are typically used in commercial real estate and investment properties. The DSCR is a financial metric that measures a property’s ability to generate enough income to cover its debt obligations. Follow along for a quick breakdown.

Key Points about DSCR Loans:

- DSCR Definition:

- DSCR = Net Operating Income (NOI) / Total Debt Service (TDS).

- A DSCR of greater than 1 indicates that the property generates more income than needed to cover debt payments.

- Importance:

- Lenders use DSCR to assess the risk of a loan. A higher DSCR suggests lower risk, as the property is more likely to generate sufficient cash flow.

- 20% – 35% down depending on the scenario to get the DSCR ratio to work.

- Common Ratios:

- A DSCR of 1.2 is often considered a minimum for many lenders, meaning the property generates 20% more income than required to meet debt obligations.

- Types of Properties:

- Commonly used for single family residence, multifamily units, and other income-generating properties.

- Loan Terms:

- Interest rates and terms can vary based on the DSCR, property type, and borrower profile.

- Considerations:

- Lenders may require detailed financial documentation to calculate the DSCR accurately. The appraiser provides a rent schedule to determine the allowable rent.

If you are considering purchasing a rental property and want to learn more about your options, have specific questions or just need more details, don’t hesitate to connect with us and ask. Connect with us here or directly with Michelle by visiting here.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link